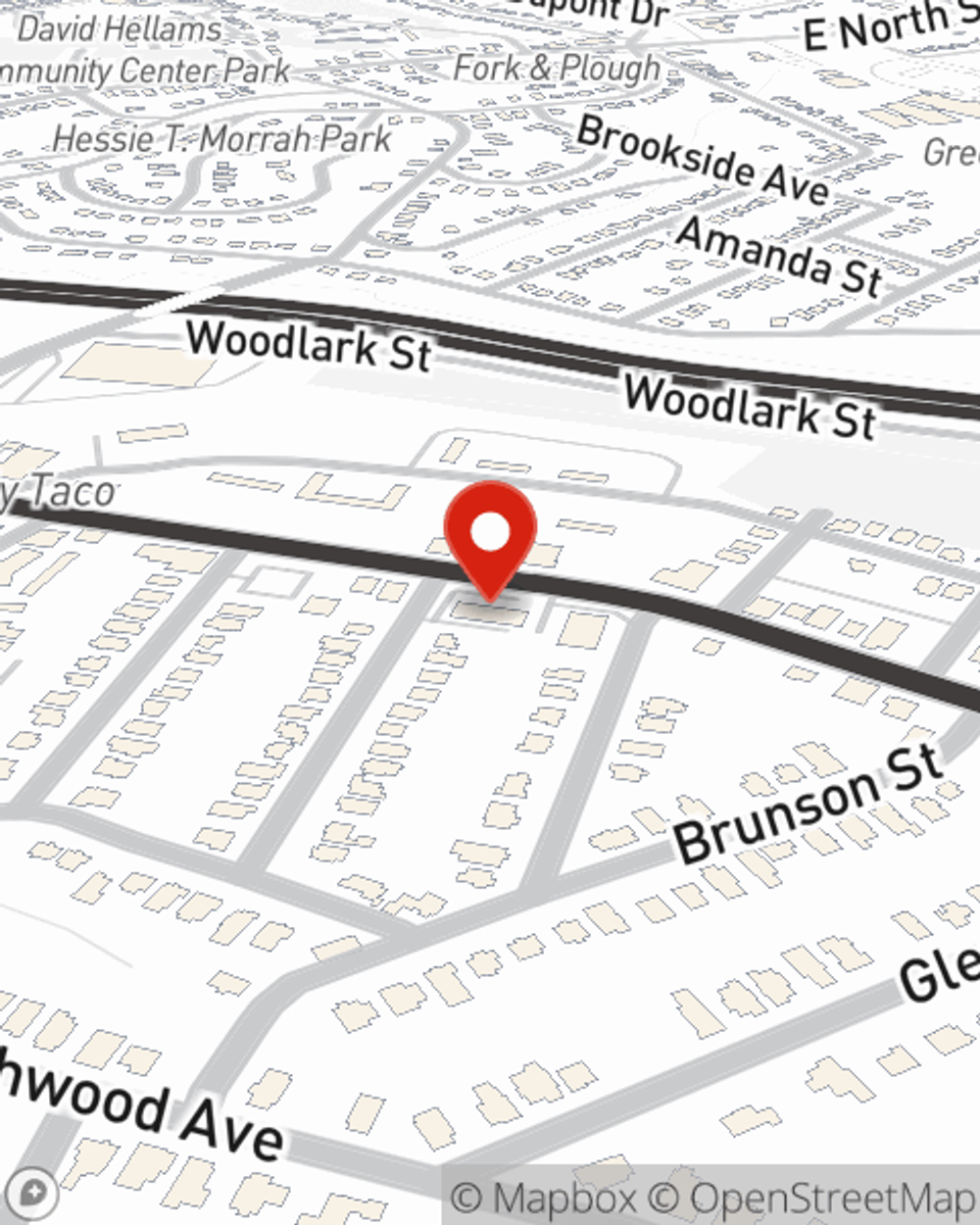

Business Insurance in and around Greenville

One of the top small business insurance companies in Greenville, and beyond.

No funny business here

State Farm Understands Small Businesses.

Small business owners like you have a lot on your plate. From tech support to inventory manager, you do as much as possible each day to make your business a success. Are you a barber, an acupuncturist or a florist? Do you own an art gallery, an acting school or a fabric store? Whatever you do, State Farm may have small business insurance to cover it.

One of the top small business insurance companies in Greenville, and beyond.

No funny business here

Protect Your Business With State Farm

Your business thrives off your determination passion, and having reliable coverage with State Farm. While you make decisions for the future of your business and put in the work, let State Farm do their part in supporting you with commercial liability umbrella policies, commercial auto policies and business owners policies.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Parker Smith's office today to identify your options and get started!

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Parker Smith

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.